Credit Karma is a financial technology company that has gained significant traction in the realm of personal finance management. Founded in 2007, it offers users free access to their credit scores and credit reports, along with various financial tools designed to help individuals make informed decisions about their finances. The platform primarily focuses on providing users with insights into their credit health, enabling them to understand the factors that influence their credit scores.

By leveraging data from major credit bureaus, Credit Karma allows users to track their credit scores over time, offering a comprehensive view of their financial standing. The service operates on the premise that knowledge is power, particularly when it comes to managing one’s finances. Users can access their credit scores from TransUnion and Equifax, two of the three major credit bureaus in the United States.

This access is not only beneficial for individuals looking to improve their credit scores but also for those who want to monitor their credit for any potential inaccuracies or fraudulent activities. Credit Karma’s user-friendly interface and mobile app make it easy for users to navigate their financial information, providing a seamless experience that encourages regular engagement with one’s credit health.

The Accuracy of Free Credit Scores

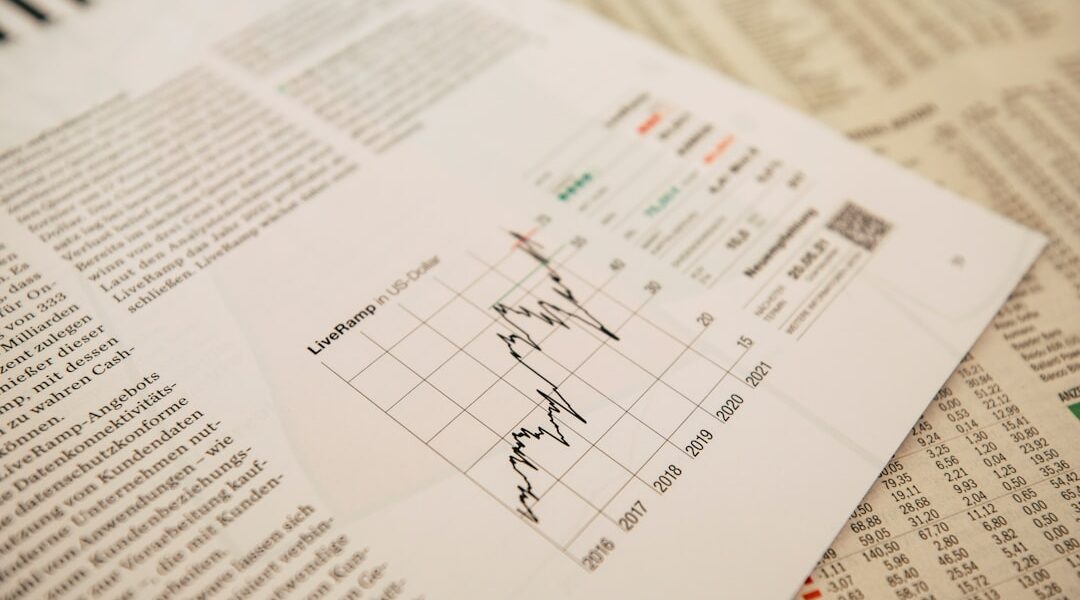

When it comes to free credit scores, accuracy is a critical concern for many users. Credit Karma provides users with VantageScore 3.0 scores, which differ from the FICO scores that lenders typically use. While both scoring models assess similar factors—such as payment history, credit utilization, and length of credit history—their algorithms can yield different results.

This discrepancy can lead to confusion among consumers who may not fully understand the nuances between these scoring systems. It is essential for users to recognize that while Credit Karma’s scores are a useful tool for monitoring trends in their credit health, they may not always reflect the exact score a lender would see. Moreover, the accuracy of the information presented on Credit Karma is contingent upon the data reported by the credit bureaus.

Users may find that their Credit Karma score fluctuates due to changes in their credit report, such as new accounts being opened or late payments being recorded. While Credit Karma strives to provide up-to-date information, there can be delays in reporting from the bureaus, which may result in discrepancies between what users see on Credit Karma and what lenders see when they pull a credit report. Therefore, while Credit Karma is an excellent resource for tracking credit health, users should also consider obtaining their FICO scores directly from lenders or through other services for a more comprehensive understanding of their creditworthiness.

The Impact of Credit Inquiries

Credit inquiries play a significant role in determining an individual’s credit score and overall credit health. There are two types of inquiries: hard inquiries and soft inquiries. Hard inquiries occur when a lender checks your credit report as part of their decision-making process for a loan or credit application.

These inquiries can have a negative impact on your credit score, typically resulting in a slight decrease that may last for several months. On the other hand, soft inquiries do not affect your score and occur when you check your own credit or when a lender pre-approves you for an offer without your explicit request. Understanding the impact of these inquiries is crucial for anyone looking to maintain or improve their credit score.

For instance, if an individual applies for multiple loans or credit cards within a short period, the resulting hard inquiries can signal to lenders that they may be experiencing financial distress, potentially leading to higher interest rates or outright denials. Therefore, it is advisable for consumers to space out their applications and limit hard inquiries to necessary situations. Credit Karma provides users with insights into their recent inquiries, allowing them to monitor how these actions may be affecting their overall credit profile.

The Importance of Monitoring Your Credit

| Reasons to Monitor Your Credit | Benefits |

|---|---|

| Identity Theft Protection | Early detection of unauthorized activity |

| Financial Health | Understanding your credit score and report |

| Loan Approval | Higher chances of getting approved for loans |

| Interest Rates | Potential for lower interest rates |

Regularly monitoring your credit is essential for maintaining financial health and ensuring that you are aware of any changes that could impact your ability to secure loans or favorable interest rates. By keeping an eye on your credit report and score, you can identify potential issues early on, such as inaccuracies or signs of identity theft. For example, if you notice an unfamiliar account on your report, it could indicate that someone has fraudulently opened an account in your name.

Addressing such issues promptly can prevent long-term damage to your credit score. Additionally, monitoring your credit allows you to track your progress over time as you work towards improving your score. Whether you are paying down debt, making timely payments, or reducing your credit utilization ratio, observing these changes can provide motivation and insight into what strategies are most effective for enhancing your credit profile.

Credit Karma’s platform facilitates this process by offering users regular updates on their scores and personalized recommendations based on their financial behavior. This proactive approach empowers individuals to take control of their financial futures and make informed decisions.

Credit Karma’s Credit Monitoring Services

Credit Karma offers robust credit monitoring services that alert users to significant changes in their credit reports. This feature is particularly valuable for individuals who want to stay informed about their credit status without having to check manually. Users receive notifications when there are new accounts opened in their name, changes in account balances, or alterations in payment history.

Such alerts enable users to act quickly if they suspect fraudulent activity or if they need to address any discrepancies in their reports. The service also provides users with access to their credit reports from TransUnion and Equifax at no cost. This transparency allows individuals to review their reports thoroughly and understand the factors contributing to their credit scores.

By offering insights into what affects a user’s score—such as payment history or credit utilization—Credit Karma helps individuals make informed decisions about how to improve their financial standing. The combination of real-time monitoring and educational resources positions Credit Karma as a valuable ally in navigating the complexities of personal finance.

Credit Karma’s Financial Tools and Resources

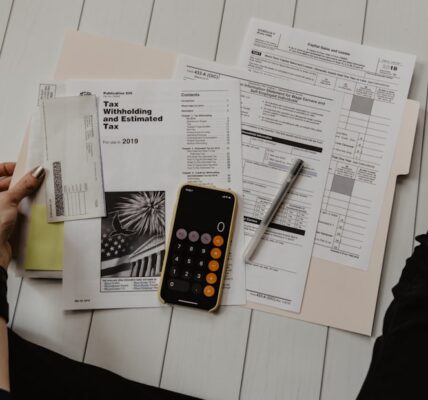

Beyond credit monitoring, Credit Karma offers a suite of financial tools and resources designed to assist users in managing various aspects of their finances. One notable feature is the loan comparison tool, which allows users to explore different loan options based on their credit profiles. By inputting specific criteria such as loan amount and purpose, users can receive personalized recommendations for loans that suit their needs while also comparing interest rates and terms from various lenders.

Additionally, Credit Karma provides tax filing services that simplify the often daunting process of preparing and submitting tax returns. Users can access free tax filing options that guide them through the necessary steps while maximizing potential deductions and credits. This integration of financial services not only enhances user experience but also positions Credit Karma as a comprehensive platform for managing personal finances holistically.

By offering tools that address various financial needs—from loans to taxes—Credit Karma empowers users to take charge of their financial journeys with confidence.

How Credit Karma Makes Money

While Credit Karma offers its services for free, it operates on a business model that generates revenue through partnerships with financial institutions. When users apply for loans or credit cards through the platform, Credit Karma receives compensation from lenders for referring potential customers. This affiliate marketing approach allows Credit Karma to provide its core services without charging users directly while still maintaining profitability.

Moreover, Credit Karma utilizes data analytics to enhance its offerings and improve user experience. By analyzing user behavior and preferences, the platform can tailor its recommendations more effectively, increasing the likelihood that users will engage with its partner products. This symbiotic relationship benefits both consumers—who gain access to relevant financial products—and lenders—who receive qualified leads from interested borrowers.

As such, Credit Karma has successfully carved out a niche in the competitive landscape of personal finance management by leveraging its user base and data-driven insights.

Alternatives to Credit Karma

While Credit Karma is a popular choice for many individuals seeking free access to their credit scores and monitoring services, several alternatives exist that may cater to different preferences or needs. One notable alternative is Experian, which offers free access to FICO scores along with comprehensive credit monitoring services. Experian’s platform also includes identity theft protection features, making it an appealing option for those particularly concerned about security.

Another alternative is Mint, which focuses more broadly on personal finance management rather than solely on credit scores. Mint allows users to track spending habits, create budgets, and manage bills while also providing access to free credit scores through its partnership with TransUnion. This holistic approach can be beneficial for individuals looking to gain insights into their overall financial health rather than just focusing on credit metrics.

In addition to these options, there are other platforms like NerdWallet and WalletHub that provide free access to credit scores along with personalized financial advice and product recommendations. Each of these alternatives has its unique features and strengths, allowing consumers to choose the service that best aligns with their financial goals and preferences. As the landscape of personal finance continues to evolve, individuals have an array of tools at their disposal to help them navigate their financial journeys effectively.

FAQs

What is Credit Karma?

Credit Karma is a free online service that provides consumers with access to their credit scores and credit reports from two of the major credit bureaus, TransUnion and Equifax.

Is Credit Karma really free?

Yes, Credit Karma is a free service for consumers. They make money through targeted advertising and by recommending financial products and services to users based on their credit profile.

How does Credit Karma provide free credit scores?

Credit Karma partners with TransUnion and Equifax to provide consumers with free access to their credit scores. They make money by recommending financial products and services to users based on their credit profile.

Are the credit scores provided by Credit Karma accurate?

The credit scores provided by Credit Karma are accurate and are based on the VantageScore 3.0 model, which is a commonly used credit scoring model. However, it’s important to note that lenders may use different scoring models when making lending decisions.

Does using Credit Karma affect my credit score?

No, checking your credit scores through Credit Karma does not affect your credit score. This is because Credit Karma uses a “soft inquiry” to provide you with your credit scores, which does not impact your credit.

Can I trust Credit Karma with my personal information?

Credit Karma takes the privacy and security of its users’ personal information seriously. They use encryption and other security measures to protect users’ data. However, as with any online service, it’s important to be cautious and vigilant about sharing personal information.